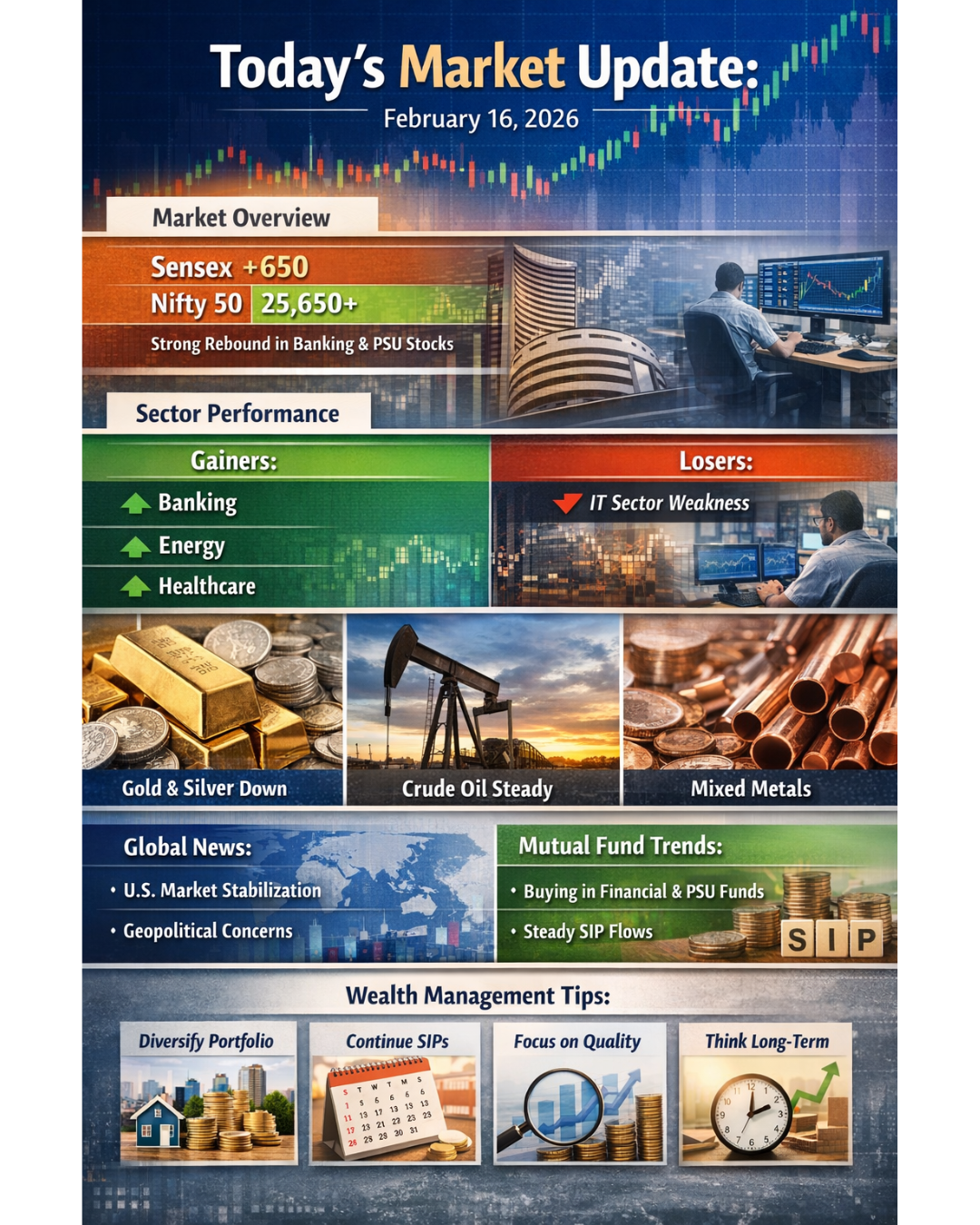

Market Wrap Today: Sensex & Nifty End Lower | Gold & Silver Surge | Investment Outlook

Key Market Numbers – 10 December 2025

- BSE Sensex ended at 84,391.27, down about 275 points today.

- Nifty 50 closed at 25,758.00, down ~82 points (-0.32%).

- Gold (24K) is trading at approximately ₹ 13,031 per gram.

- Silver has surged: current price is around ₹ 1,99,000 per kg.

- Global crude oil price — while exact oil-price in INR isn’t always in local press, broader global oil price trends remain relevant for inflation and macro outlook.

Today’s Market Wrap – What Happened

- Domestic benchmarks opened on a mixed-to-positive note: Nifty 50 and BSE Sensex posted modest gains early in the session.

- But by close, sentiment cooled — profit-taking and caution ahead of global developments led to a downturn. Sensex ended down ~275 points and Nifty slid below 25,800.

- Broader-market participation was reasonably healthy: mid-caps and small-caps registered small gains alongside large-cap rebounds.

- Key drivers today: global uncertainty (as investors await policy moves by Federal Reserve), foreign fund flows, and currency-rupee movement.

What this tells us: The market is oscillating — showing resilience but also vulnerability. Gains get reversed when global headwinds or liquidity concerns surface. It’s a reminder that near-term volatility remains non-trivial even if long-term fundamentals may support growth.

Global Cues & Foreign Markets — Why They Matter

- Global stock market trends continue to influence Indian equities strongly. Economic developments abroad, interest-rate moves, and currency fluctuations (especially USD vs INR) ripple into India’s market sentiment.

- For Indian investors, exposure to foreign markets — whether directly or via global/international mutual funds — is becoming increasingly relevant. Such investments allow participation in different economies and help cushion domestic-market volatility

- That said, investing globally comes with added considerations: currency risk, geopolitics, macroeconomic shifts abroad. Funds denominated outside India can magnify returns — or losses — depending on forex moves and economic cycles.

Takeaway: Global diversification isn’t just a buzzword — for many Indian investors, it’s becoming a necessity. Particularly in volatile times, global exposure can smooth out swings and offer alternate growth paths.

Mutual Funds & Wealth-Management Lens

For investors who don’t want to pick individual stocks, mutual funds — especially hybrid or global/international mutual funds — provide a balanced approach. They combine diversification, professional management, and exposure across geographies or asset classes.

- Hybrid funds — mixing equity, debt, and sometimes international assets — are gaining popularity because they help balance return potential with risk mitigation, especially when equity markets are volatile.

- For long-term wealth creation, it's wise to periodically review your asset allocation (equity vs debt vs international), and perhaps use SIPs (systematic investments) in mutual funds to ride through market ups and downs — rather than trying to time the market.

- Smart strategy: A mix of domestic equity funds + international/global mutual funds + debt/fixed-income funds can balance growth and stability — especially in a world of rising global uncertainty.

What Investors Should Watch — And What to Do

Watch out for:

- Global macro events — especially rate decisions by central banks abroad (e.g. the Fed), currency moves, and geopolitical tension — that can shake markets suddenly.

- Domestic indicators — earnings cycles, rupee movement, inflation/interest-rate policy from local central banks, and foreign fund inflows or outflows.

What you can do:

- Diversify — don’t put all eggs in one basket (single stock or single market). Use mutual funds (domestic + global) to spread risk.

- Maintain long-term horizon — short-term volatility is expected, but over 3–5+ years, diversified portfolios tend to smooth out turbulence.

- Review periodically — rebalance asset allocation as needed, especially after sharp market moves or macro shifts.

Final Thoughts

Today’s market behaviour underscores a simple truth: we operate in a globally interconnected financial ecosystem. Domestic markets don’t move in isolation — they respond quickly to global cues. For investors, that means opportunity — but also responsibility.

A balanced, diversified approach — blending Indian equities, global exposure, and conservative instruments — remains among the soundest ways to manage wealth in uncertain times.